Partial year depreciation calculator

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Both prime cost and diminishing value methods of depreciation to help you decide which method is best for you.

Long Term Assets Lecture 6 Partial Year Using Straight Line Depreciation Youtube

Depreciation is an annual income tax deduction that al-lows you to recover the cost or other basis of certain prop-erty over the time you use the property.

. About the Authors. Even for partial use of plants scrap value will remain same. As an example a company buys a new machine for 165000 in 2011.

Mcdougal littell algebra 1 download. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200. Algebra equations with multivariables.

Since 2019 insurance companies have also started offering Bundled car insurance policy for brand new cars. Math permutations and combinations worksheet. Attach Form 1040-NR Schedules OI A and NEC to Form 1040-NR as.

Try it for free. Detailed 40 year forecast illustrating all depreciable items. It is an allowance.

One method is called partial year depreciation where depreciation is calculated exactly at when assets start service. Estimated allocation to 5 7 15 and real property. Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts.

In regards to depreciation salvage value sometimes called residual or scrap value is the estimated worth of. Using simple calculator you can type 025 and press ie. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

Amar Patel Director Atlanta Amar spent 14 years at PwC and one year at Centiv LLC focusing on various specialty tax products including Cost Recovery Solutions and Research Development Tax CreditsIn the past 15 years of practice Amar has become an expert in cost segregation and large fixed asset depreciation reviews for purposes. The cost is listed in cell C2 50000. 450000 less your 150000 basis.

Net present value over 10 years and over the life of the property. The salvage value is 15000 and the machines useful life is five years. ASCII characters only characters found on a standard US keyboard.

If you find calculating Depreciation rates for either SLM or WDV time-consuming you can always use our free Depreciation Calculator at this link. Salvage is listed in cell C3 10000. Real estate depreciation on rental property can lower your taxable income.

We welcome your comments about this publication and your suggestions for future editions. Quadratic equation on ti89. Ti graphing simultaneous equations.

By convention most US. Find out how it works and how it can save you money at tax time. Get 247 customer support help when you place a homework help service order with us.

This car insurance policy offers 3-year third party plus 1-year own damages cover to car owners. Simply select Yes as an input in order to use partial year depreciation when using the calculator. The company should record depreciation of 30000 every year for the next five years.

Beginning with tax year 2020 nonresident alien taxpayers will file a redesigned Form 1040-NR which is similar to the Form 1040. Free calculator games ti-84. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

This type of car insurance plan is available only if the car owner already has a third-party car insurance policy for the insured vehicle. Residential rental property. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

A BMT depreciation schedule includes the following components. The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019. Ice during the tax year exceeds 2620000.

Property depreciation for real estate related to. 6 to 30 characters long. Licensees must be at least 18 years of age.

A general depreciation system uses the declining-balance. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. 2 Average cost basis is important because it impacts the net income calculation and profitability figures.

We welcome your comments about this publication and suggestions for future editions. Under thedouble declining balance method the 10 straight line. For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg.

NW IR-6526 Washington DC 20224. And life for this formula is the life in periods of time and is listed in cell C4 in years 5. TI-83 graphing calculator sample practice math test question using graphing calculator middle school learn algebra 1.

All applicants who qualify for the examination have one year and up to five tries to pass the examination. Nonresident alien taxpayers should use Form 1040-NR. NW IR-6526 Washington DC 20224.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. You would have to report a 50000 capital gain on your tax return for the year because 300000 is 50000 more than the 250000 exclusion. Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi.

Enter basic building info and instantly receive the estimated. Beginning with tax year 2020 Form 1040-NR-EZ is no longer available. The effective life and depreciation rate for all division 40 plant and equipment assets.

The Cost Segregation Savings Calculator estimates your federal income tax savings and provides. General Depreciation System - GDS. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

We need to define the cost salvage and life arguments for the SLN function. All applicants who successfully pass an examination have one year from the day they passed to request issuance of their license. You can calculate and claim a partial home sales exclusion.

Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years begin-. The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. Tax deductions and additional cash flow by year.

Must contain at least 4 different symbols. Section 179 deduction dollar limits.

9 Arithmetic Sequence Examples Doc Pdf Excel Arithmetic Sequences Geometric Sequences Quadratics

Depreciation Accounting Sum Of Years Digits Method With Partial Period Allocation Youtube

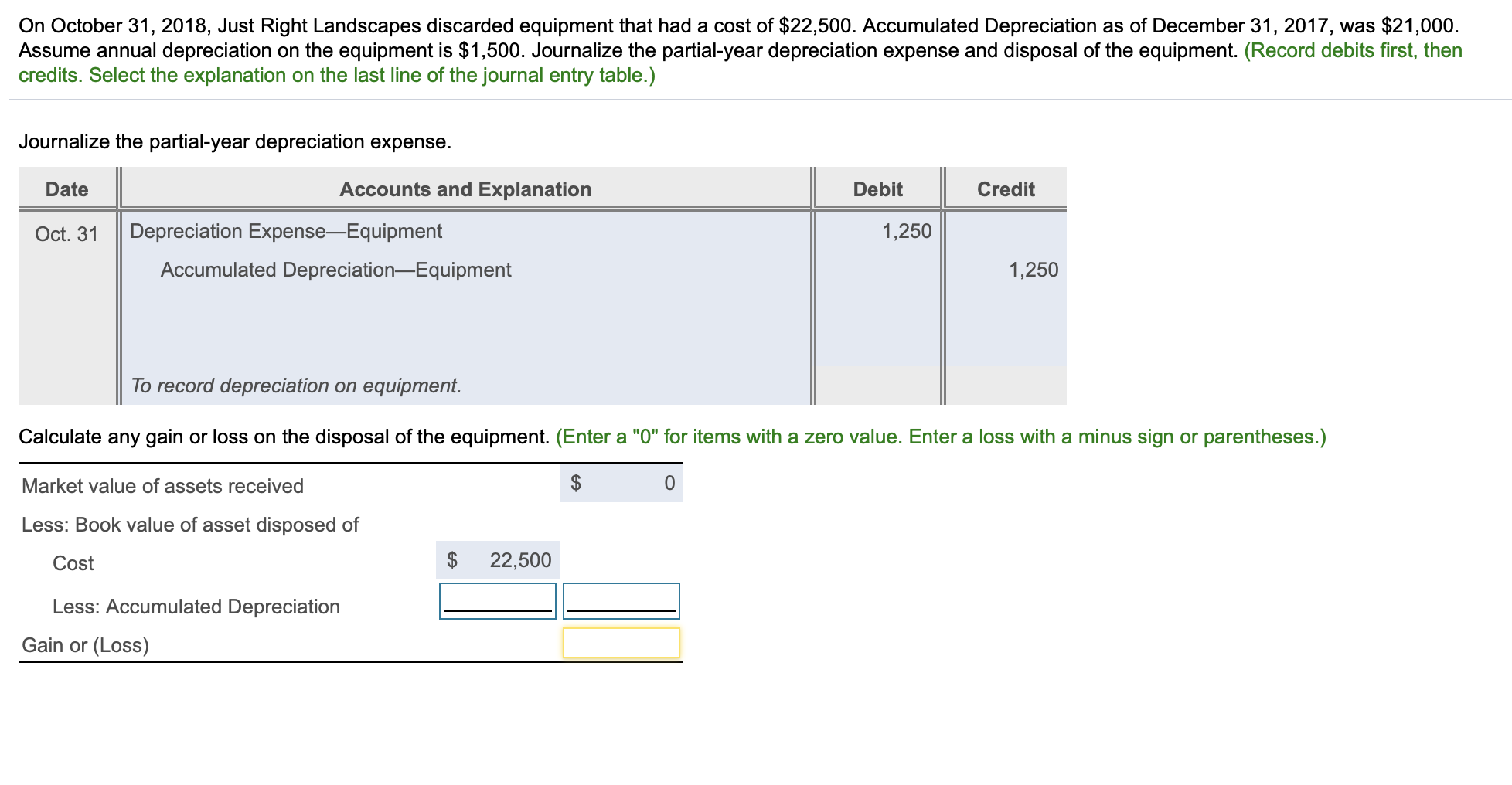

Solved On October 31 2018 Just Right Landscapes Discarded Chegg Com

1

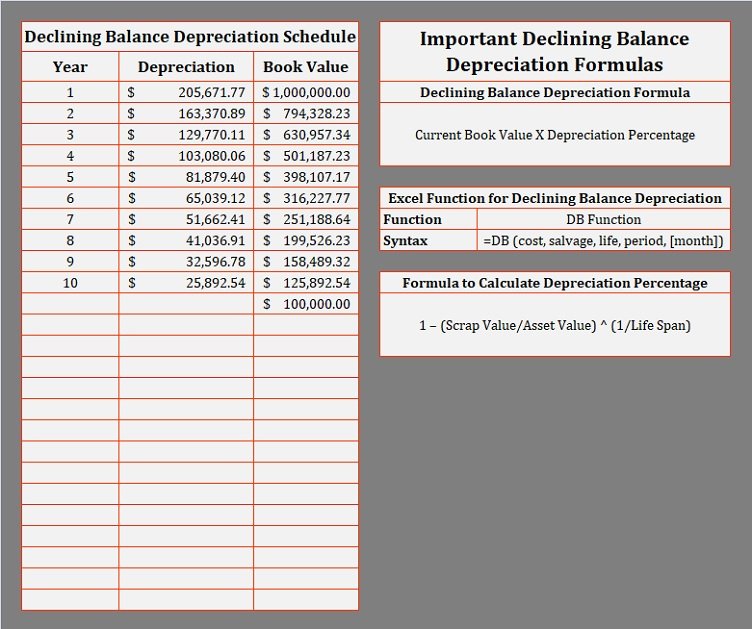

Declining Balance Depreciation Calculator Template Msofficegeek

Depreciation Accounting Sum Of Years Digits Method With Partial Period Allocation Youtube

Units Of Production

Declining Balance Depreciation Calculator Template Msofficegeek

Chapter 18 Buying Plant Assets And Paying Property Tax Ppt Download

1

Partial Year Depreciation Financial Accounting Youtube

2

Declining Balance Depreciation Calculator

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

6 7 Partial Year Depreciation Youtube

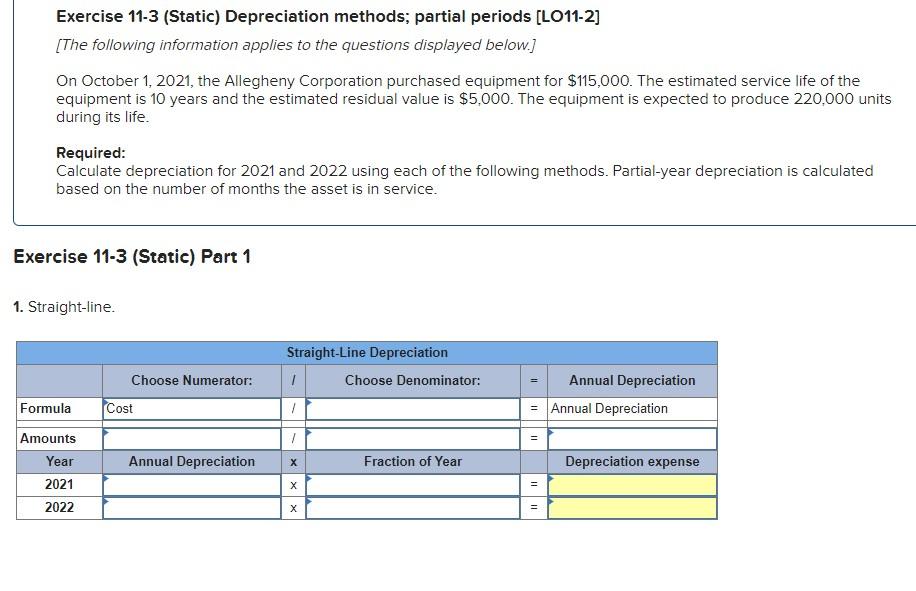

Solved Exercise 11 3 Static Depreciation Methods Partial Chegg Com

Declining Balance